arizona estate tax exemption 2021

The Estate Tax Exemption Amount Goes Up for 2021. A person is considered to reach age 65 on the day before his or.

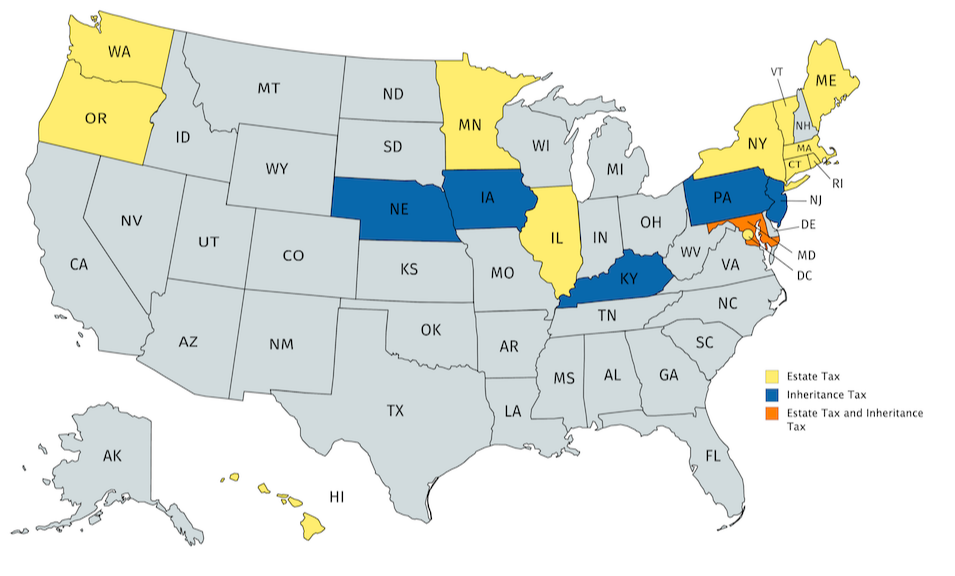

Is There An Inheritance Tax In Arizona

The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022.

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

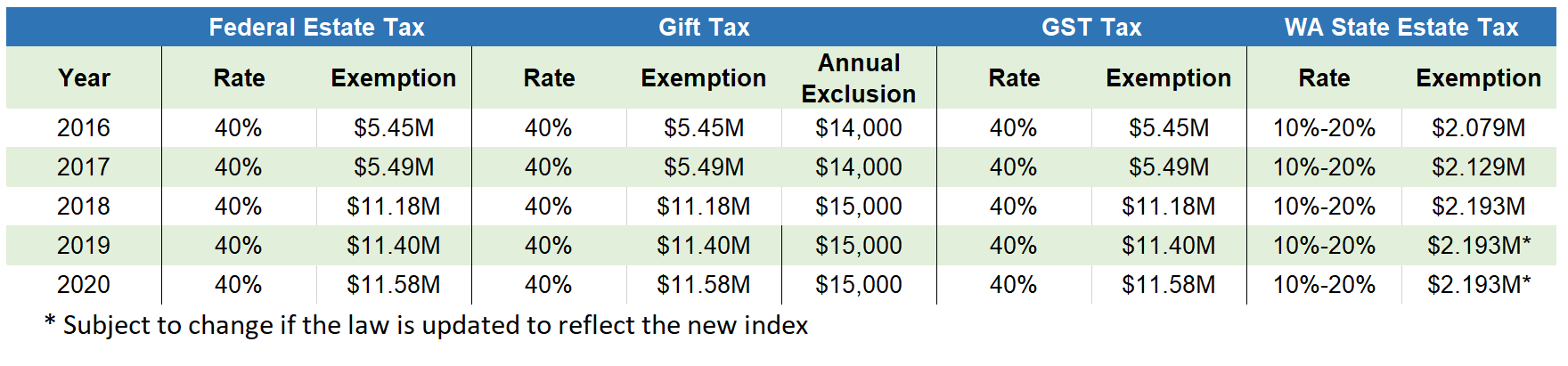

. TPT Exemption Certificate - General. 1600 West Monroe Street. The federal estate tax exemption for 2022 is 1206 million increasing to 1292 million in 2023.

Federal law eliminated the state death tax credit. 2021 HIGHLIGHTS Filing Requirement. Once you calculate your gross estate and then deduct any.

The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine-month. Even though Arizona does not assess an estate or gift tax The federal government certainly does.

Estate Tax Planning wpadmin 2021-09-09T123132-0700. TRA 2010 is now permanent under ATRA 2012 as indexed for inflation. Effective for taxable year 2018 organizations exempt under Internal Revenue Code 501 are exempt from Arizona income tax.

The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. The purpose of the Certificate is to. Federal estate tax planning.

Arizona Disability Property Tax Exemption. Due to the Tax Cuts and Jobs Act signed into law in 2017 the estate tax exemption limit has been gradually increased over the past four years. This Certificate is prescribed by the Department of Revenue pursuant to ARS.

Estate Tax Planning in Arizona. It is to be filled out completely by the purchaser. Disabled citizens and veterans could get a 3000 property tax exemption given that the assessed value of their property is less than 10000.

Arizona Department of Revenue. No estate tax or. No estate tax or inheritance tax.

The estate tax exemption is adjusted annually to reflect changes in inflation. An individual may claim itemized deductions on an Arizona return even if taking a standard deduction on a federal return. Serving Queen Creek Gilbert Mesa San Tan and the entire East Valley Facebook-f Twitter Linkedin-in Youtube.

For the most part an individual may. Exemptions and deductions are specific to each classification. In Arizona as of 2022 all property is taxable unless exempted under the laws of the United States in Title 42 Chapter 11 Article 3.

This establishes a basis for state and city tax deductions or exemptions. Property tax exemptions in Arizona.

Is There An Inheritance Tax In Arizona

What S The Estate Tax Exemption For 2021 Lifeplan Legal Az

Is There An Inheritance Tax In Arizona

Estate Tax Exemption 2021 Amount Goes Up Union Bank

2020 Estate Planning Update Helsell Fetterman

Applying For A Property Tax Exemption In Arizona Without A 501 C 3 Letter Provident Lawyers

Arizona Estate Deed Fill Out Sign Online Dochub

State Estate And Inheritance Tax Treatment Of 529 Plans

Arizona Renouncement Of Inheritance Arizona Inheritance Us Legal Forms

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

Estate Taxes In Phoenix Arizona Az

Estate Tax What To Expect From Upcoming Changes Fee Based Wealth Management And Financial Planning

2021 State Corporate Tax Rates And Brackets Tax Foundation

Is There An Inheritance Tax In Arizona

Estate And Inheritance Taxes Urban Institute

A Brief History Of The Estate Tax And Potential Implications For The Upcoming Election Fee Based Wealth Management And Financial Planning

Arizona Estate Planning Income Estate Gift And Gst Taxation Forms And Practice Manual

Do I Need To Pay Tax On My Inheritance In Arizona Phelps Laclair

The Revised Arizona Homestead Exemption Is The Homestead Exemption Still Beneficial Provident Lawyers